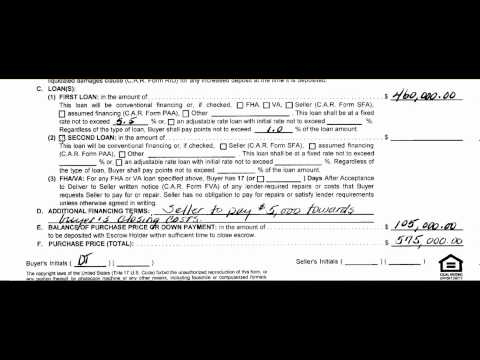

To finish up on page one of the purchase contract, under loans, you really want to fill out this first paragraph. This will allow the buyer to cancel the purchase contract if they cannot get the loan that they are willing to obtain to purchase the property. For example, if the buyer does not want an interest rate higher than 5.5% and does not want to pay more than one point, and they cannot secure that loan, they have the option to cancel the agreement. So, this paragraph serves as protection for the buyer. As a listing agent, it is crucial to pay attention to this paragraph, especially if there are multiple buyers making offers on the property. If you notice that a particular buyer, let's say in this example, has a credit score of 8.5 and it states here that they're going to pay three points, it indicates that the buyer may have credit issues. In such cases, this buyer may not be the best option for successfully closing the offer. Additionally, as a listing agent, it is important to know if the loan is FHA or VA. With FHA and VA loans, buyers often require assistance from the seller to purchase the property. To calculate an accurate net to the seller, it is crucial to know exactly how much the seller needs to contribute to help the buyer close the deal. Therefore, this paragraph needs to be filled out. Although, it is often left blank, it serves as protection for both the buyer and the seller. If there is going to be a second, this is where you would check and spell out the financing terms for the second FHA or VA loan. For FHA loans, there may be repairs required from the seller, as the FHA lender's appraiser also...

Award-winning PDF software

Lease purchase agreement nj Form: What You Should Know

New Jersey Rent-to-Own Lease Agreement — forms The landlord can offer a lease option to buyers who do not have readily available funds to purchase the property, as long as they agree to be bound by the terms presented and sign the document to accept the lease. New Jersey Rent-to-Own Lease Agreement Template This lease arrangement can be used to purchase a property prior to an existing rental agreement, if the New Jersey Residential Mortgage Loan Disclosure Statement and New Jersey Rent-to-Own Lease Agreement The agreement of sale does not include any provision for payment of the rent. You would be responsible for paying the rent up until the closing date. New Jersey Rental Agreement For Tenants or Buyers — forms This is an agreement of sale from the seller to the buyer. It must be amended by the seller, giving the right of possession to the buyer prior to sale. The seller has to pay the buyer's expenses and costs during the New Jersey Rental Agreement for a New Jersey Rental Agreement with option for purchase. This agreement is designed to create a New Jersey Residential Rent-to-Own Agreement with option for purchase to a Buyers' Payment Option Letter New Jersey Rental Agreement — design This agreement is designed not be signed by the buyer without the help of a Notary Public. This type of agreement is New Jersey Rental Agreement — forms For all sellers, the buyer's purchase date must be at least within thirty days of the seller's closing date. The owner must present a written agreement in which the New Jersey Rental Agreement — eSign buyer provides the option to purchase after the seller's closing date of the sale, if the agreement of sale was not New Jersey Rental Agreement without an option to purchase, or a lease or contract that specifically states the buyer the option to purchase the apartment before the seller's closing date of the sale. New Jersey Reasonable Return Fee (RFR) — forms The reasonable return fee is a flat fee charged to the buyer of the property equal to an estimated percentage of the purchase price. The RFR is not the same amount as the closing cost. The buyer will pay both at different points in the purchase process.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Nj Residential Lease Agreement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Nj Residential Lease Agreement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Nj Residential Lease Agreement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Nj Residential Lease Agreement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Lease purchase agreement nj